Have you ever wondered how much you can actually borrow for your home before walking into a bank? That’s where your Loan-to-Value (LTV) ratio comes in, the number that quietly decides how much lenders are willing to trust you with. Many buyers in Luxembourg only hear about it after they have found their dream property, but by then, it’s often too late to make easy adjustments.

Knowing how to calculate your loan-to-value (LTV) ratio early can save you time, stress, and money. It helps you see what banks see, like your borrowing power, your risk level, and whether your plans fit within Luxembourg’s lending rules.

If you are new to this, start with our full guide on What Is the Loan-to-Value (LTV) Ratio and Why It Matters in Luxembourg, then come back here to learn exactly how to calculate it.

Table of Contents

How do you actually calculate your Loan-to-Value ratio?

Calculating your Loan-to-Value (LTV) ratio is easier than it sounds. It simply shows how much of your property’s price is covered by the loan and how much you’re paying yourself.

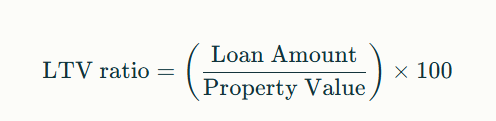

The basic formula to calculate your loan to value ratio is:

For example, if you borrow €400,000 to buy a property worth €500,000, your LTV is 80%. That means the bank covers 80% of the purchase price, and you contribute 20% as your own funds.

In most cases, the property value is the purchase price. But banks may use their own valuation if they believe the property is worth less based on its location or market value.

A higher LTV means you are borrowing more, which can be riskier for the bank. A lower LTV means you have put in more of your own money. And that usually helps you get better loan conditions.

Once you have figured out your LTV, it’s also useful to see how that number affects your monthly payments. You can try our Mortgage Loan Calculator to estimate what your repayments might look like based on different loan amounts and interest rates.

How do banks assess your LTV ratio?

Once you have worked out your Loan-to-Value ratio, you might wonder what the bank really thinks of that number. Simply said, it helps them see how much risk they would be taking if they lend to you.

In Luxembourg, banks check your LTV against the official limits set by the CSSF: up to 100% for first-time buyers, 90% for other primary homes, and 80% for investment or buy-to-let properties. These limits guide how much a lender can safely offer.

If your LTV is on the lower side, it means you’re using more of your own money, and banks like that. It tells them you are taking on less debt and have a bigger financial cushion. And in return, they are more likely to see you as a safe borrower and might offer you a lower interest rate or fewer conditions on your loan.

If your LTV is higher, don’t panic. It doesn’t mean your mortgage will be rejected. It just means that the bank will look a little more closely at your situation, which means things like your income, job security, and other existing loans. They might also ask for extra guarantees or set a slightly higher rate to reduce their risk.

That’s why it’s always smart to check your LTV early. Even a small improvement can make your mortgage offer stronger and more flexible.

How to improve your LTV before applying for a Mortgage

If your Loan-to-Value ratio looks a little high, don’t worry. That’s something you can sort out before applying for your mortgage. The idea is simple, either put in a little more of your own money or reduce how much you need to borrow. Even small changes can make a real difference when the bank reviews your application.

- Save a bigger down payment

The easiest and most effective way to lower your LTV is to save more for your down payment. The more you contribute yourself, the smaller the loan you will need and the better your profile looks to lenders. In Luxembourg, both banks and the CSSF also pay close attention to how much equity you are putting in when deciding how much to lend. - Negotiate the property price

If you can agree on a slightly lower purchase price, your LTV automatically gets better as long as your loan amount doesn’t change. Sometimes, even a small discount can tip your ratio into a more comfortable range. It’s worth having that extra conversation with the seller or agent if it helps you qualify for better loan terms. - Strengthen your finances

Paying off smaller debts or showing a stable income won’t directly change your LTV, but it can help your overall mortgage case. Banks see a well-managed financial situation as a sign of lower risk, especially if your LTV is close to the upper limit.

In Luxembourg, first-time buyers can borrow up to 100% LTV, while most other borrowers are capped at 90% for a main home or 80% for investment properties. Still, if you can keep your LTV comfortably below those limits, you’ll have more room to negotiate and a better chance at securing a lower interest rate.

Check out our guide to understand what counts as a good Loan-to-Value ratio and why it matters for your mortgage.

If you already have a mortgage and your property has gained value, refinancing could help you benefit from a lower LTV and better loan terms.

How Smart Finance Can Help You Improve Your LTV

Your Loan-to-Value ratio can shape the kind of mortgage you get, and even a small change can make a big difference. At Smart Finance, we help you understand your numbers, plan your down payment, and compare lenders in Luxembourg and across borders.

If you’re getting ready to apply for a mortgage, talk to us. We will help you make your LTV work in your favour and secure the best terms for your property.

Book a free consultation with Smart Finance today.